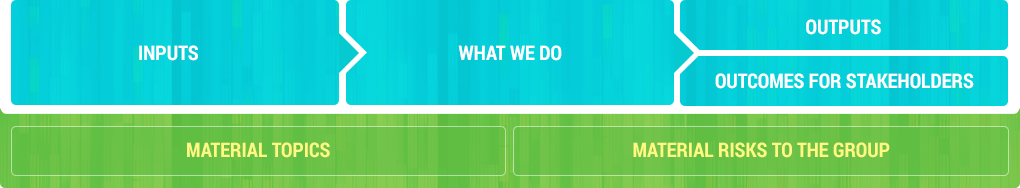

VALUE CREATION

At CLP, we utilise a range of capitals, which represent stores of value that can be built up, transformed or depleted in the production of goods or services, to create value for shareholders, customers, employees and the wider community. The following diagram shows the key capitals we used and the value we created for different stakeholders.

Inputs

Financial capital

- Shareholders’ funds of HK$105,455 million

- Total borrowings of HK$52,349 million

Manufactured capital

- Generation capacity of 19,238 equity MW

- Long-term capacity and energy purchase agreements of 4,777 MW

- Transmission and high voltage distribution lines of 16,270 km

- 15,099 primary and secondary substations in Hong Kong

Human capital

7,960 employees

Intellectual capital

- Research and development

- Innovation and technology

Natural capital

- 485,453 TJ of coal consumed

- 107,183 TJ of gas consumed

Social & relationship capital

20,015 volunteer hours by staff and family members

What we do

Digital technologies

Data analytics, artificial intelligence and Internet of Things (IoT) enable new efficiencies and delivery of smarter and more connected energy services

Generation

- Design, build, operate and invest in centralised and decentralised power stations and generation facilities

- Procure adequate and appropriate fuel and energy resources from diversified sources

Transmission

- Design, build and operate transmission networks

- Enhance transmission networks to facilitate integration of more clean energy into the grid

Distribution

- Design, build and operate distribution networks

- Integrate distributed energy resources into the grid

Customers

- Develop and deploy customer-oriented, technology-enabled energy services that help customers become active participants of a power system

Dynamic System Balancing

Design, build and operate systems that integrate centralised and decentralised generation, and balance dynamic customer demand against different generation profiles to optimise cost efficiency, reliability and environmental performance

Outputs

Reliable, clean and affordable electricity supply to customers in each of the markets we operate in

Economic value generated of HK$87,517 million

Outcomes for stakeholders

-

Employees: Staff expenses of HK$4,535 million

-

Community: Donations of HK$21 million

-

Government and Regulators: Current income tax of HK$2,189 million

-

Suppliers and Contractors: Fuel and other operating costs of HK$58,985 million*

*Excluding impairment of retail goodwill of HK$6,381 million -

Capital Providers:

- Shareholders – total dividends of HK$7,782 million, HK$3.08 per share

- Debt holders – finance costs of HK$2,033 million

Material Topics

- Responding to climate change

- Harnessing the power of technology

- Reinforcing cyber resilience and data protection

- Building an agile, inclusive and sustainable workforce

MATERIAL RISKS TO THE GROUP

- Regulatory risk: Uncertain regulatory changes, power sector reforms and regulatory compliance issues

- Financial risk: Cash flow and liquidity, credit and counterparty risks, interest rate risks, foreign currency risks, and market-to-market fair value movements

- Market risk: Economic structural changes, energy market competition and volatility as well as supply and demand imbalance

- Commercial risk: Potential losses arising from inadequate gross margins and non-performance of trading partners or counterparties

- Industrial & operational risks: Risks relating to Health, Safety, Security and Environment incidents, plant performance, human capital, data privacy, cyber attacks, and extreme weather events