A Snapshot of

2022 ANNUAL REPORT

Foundations for a Sustainable ENERGY FUTURE

Strategic Framework

The CLP Group is one of the largest investor-owned power businesses in Asia Pacific. Our strategic priorities are to create a sustainable business portfolio, accelerate our response to climate change for our business and the communities we operate in, serve growing demand for energy solutions, leverage technology to deliver leading customer experiences and enhance operating performance, and invest to build an agile and innovative workforce.

Value Creation

INPUTS USED

WHAT WE DO

CLP’S KEY STAKEHOLDERS AND OUTPUTS

At CLP, we utilise various capitals to create value for shareholders, customers, employees and the wider community.

CEO Message

Richard Lancaster

Chief Executive Officer

Business Performance

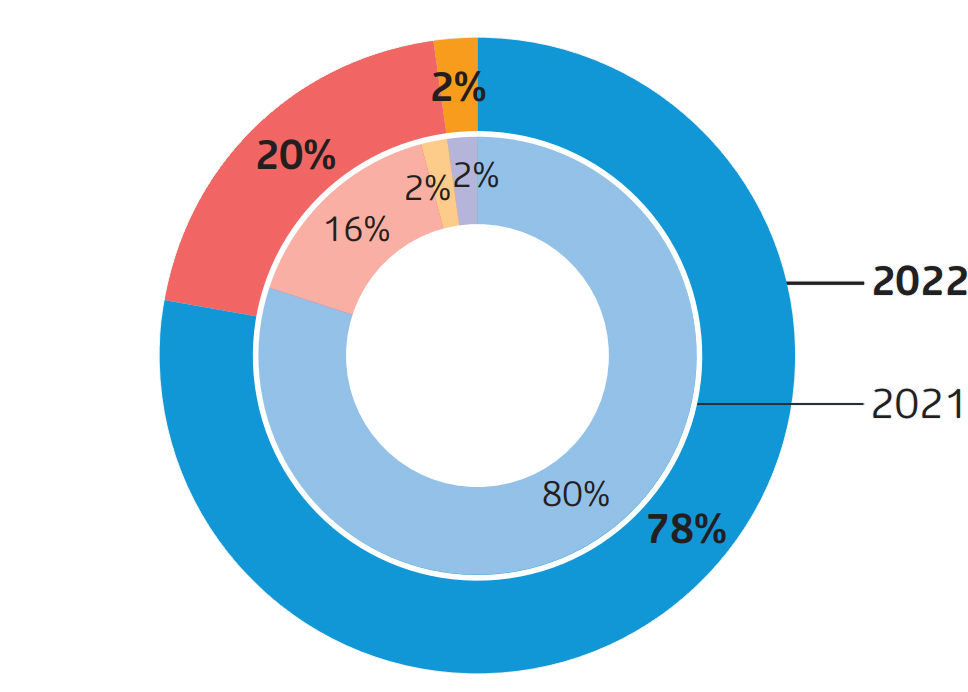

OPERATING EARNINGS (BEFORE GROUP EXPENSES) BY REGION1

Hong Kong

Mainland China

India

Southeast Asia & Taiwan

- Note: 1 Excluding the operating

- loss of HK$5,267 million (2021: HK$83 million) from Australia

Group operating earnings (before fair value loss of HK$2,937 million on energy forward contracts in Australia) reduced by HK$2,291 million to HK$7,560 million.The diagram above shows the operating earnings (before Group expenses) by region where we operate.

Financial Performance

Strong performance in Hong Kong and Mainland China, more than offset by operational challenges from our generation portfolio in Australia, resulting in Group operating earnings (before fair value loss of HK$2,937 million on energy forward contracts in Australia) reduced by HK$2,291 million to HK$7,560 million. Total earnings decreased to HK$924 million after considering this unrealised fair value loss and items affecting comparability. Dividend is maintained at the same level as in 2021.

REVENUE

FIND OUT MORE

Get the full 2022 Annual Report, and read more about our sustainability performance and the Climate-related Disclosures Report.