Business Performance

Dependable earnings and resilient operations from core markets

- Strong performance from Hong Kong and Mainland China, increased pace of renewables investments on the Mainland

- Persistent market pressures and operational setbacks in Australia

- Reallocation of capital and resources to support Hong Kong and China growth

- Consistent and reliable dividends, solid balance sheet and liquidity with credit ratings affirmed

- Delivered emissions reduction, investing in clean energy

- Hong Kong growth agenda for the 2024 Development Plan

- Smart energy businesses in operation

Performance by Region

Hong Kong

- Operating earnings up 3% to HK$8,666 million: Return on higher fixed assets reflecting progress in major projects

- 2023 tariff package: Maintain Average Basic Tariff (93.7¢/kWh) at same level for three years in a row. Fuel Clause Recovery Account and Tariff Stabilisation Fund to reduce magnitude of tariff adjustment and impact on customers

- Energy-as-a-Service businesses in operation: centralised cooling offering, Solar- and Cooling-as-a-Service, building energy management, integrated energy services

- Joint initiative with DBS Hong Kong on sustainable financing for businesses linked to energy efficiency

- Smart city: Over 1.78 million smart meters installed and 336MW of feed-in tariff projects connected or approved

Outlook

- Continued investment in current Development Plan to meet Hong Kong’s development and decarbonisation roadmap

- Commissioning of offshore LNG terminal in 2023 and CCGT D2 in operation in 2024

- 2024-2028 Development Plan submission to support Hong Kong Government’s policies to boost economic growth, attract talent and foster closer collaboration with the Greater Bay Area

- Developing Hong Kong’s future low-carbon infrastructure: ports and LNG bunkering, data centres, transport, buildings

- Manage fuel cost pressure from high international energy prices and global market volatility to alleviate tariff impact

- Support for customers and communities: HK$200 million dedicated to community support programme

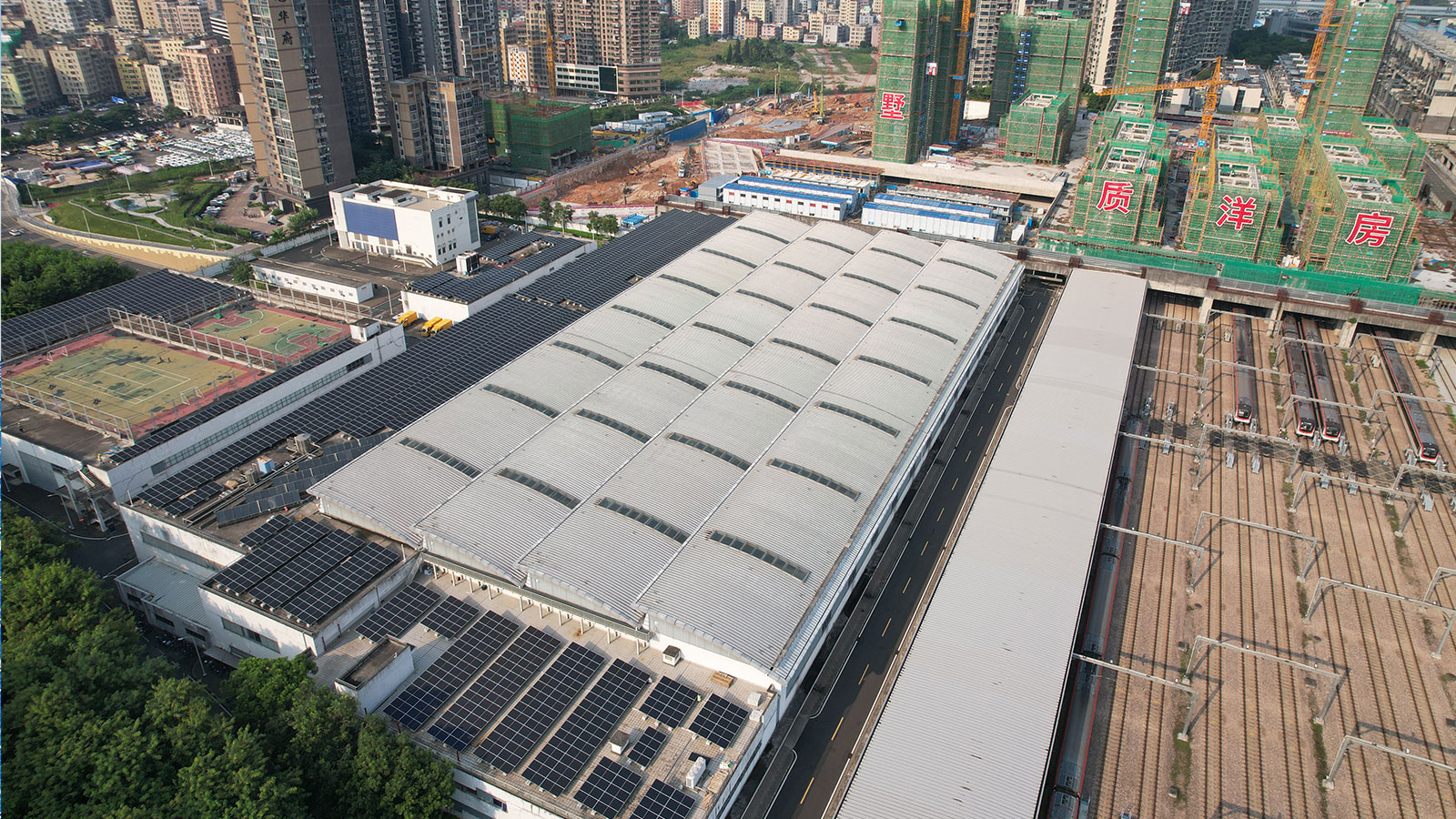

Mainland China

- Operating earnings up 34% to HK$2,229 million: Strong nuclear results and higher renewables

- Nuclear: Strong performance from Yangjiang – achieved record electricity generation. Steady performance from Daya Bay

- Renewables: Early commissioning of Qian’an III wind farm and higher hydro resources, offsetting less wind resources. Increased pace of investments

- Thermal: Fangchenggang’s performance impacted by high coal costs despite higher tariff. Sold entire 70% stake in Fangchenggang to accelerate the phase-out of coal-based assets

- Improved collection of national subsidies

Outlook

- Healthy renewables pipeline: 50MW Xundian II wind project in Yunnan, 80MW Gongdao solar plant in Jiangsu and a 100MW solar project in Guangdong to commence operations

- Scheduled major outage for Daya Bay which may affect output but nuclear projects are expected to remain main earnings driver

- Expansion of Hong Kong’s Energy-as-a-Service offerings to multinational companies in the Greater Bay Area: Solar-as-a-Service, Cooling-as-a-Service, building energy management

- Implementation of integrated energy partner strategy to develop industrial and technology parks

Australia

- Operating loss of HK$2,330 million (before fair value loss of HK$2,937 million): Lower generation at Mount Piper and Yallourn and higher costs paid to cover forward energy contract sales

- Mount Piper: Lower generation due to coal supply constraints

- Yallourn: Higher unplanned outages driven by latent and emerging age-related degradation

- Customer and others: Growing customer accounts, timing benefits from prudent hedging, ongoing margin pressure from competition and incomplete cost pass through in price regulation

Outlook

- Accelerated and targeted Yallourn maintenance programme to support generator reliability and new coal supply contract at Mount Piper to improve financial performance

- Bulk of remaining legacy forward contracts to roll off in the second half of 2023

- Continued focus on strategic cost reduction

- Supporting residential and business customers in a high wholesale price environment. Improving customer experience and offering new products and services including solar and batteries storage

- Continued pressure on retail gross margins due to rising wholesale costs and regulations

- Optimise capital structure and continue investments in energy transition projects

India

- Operating earnings down 13% to HK$193 million: Lower renewables and thermal earnings offset strong, full-year contribution from KMTL transmission project

- Renewables: Lower wind resources, partially offset by higher interest received on delayed payment from debtors

- Thermal: Lower capacity tariff for Jhajjar

- Transmission: Solid performance from KMTL project acquired in December 2021

- Significant reduction in overdue receivables on renewable projects due to the new Government scheme

- Completed sell down of additional 10% stake in Apraava Energy to CDPQ to support growth, resulting in a disposal loss. Apraava Energy deconsolidated from the Group

Outlook

- Apraava Energy will be accounted for as a joint venture going forward

- Continue investments in non-carbon assets under the partnership with CDPQ

- Completion of Sidhpur wind farm and continue to pursue collecting renewable receivables

- Roll out of advanced metering infrastructure in Assam State (700K meters) and Gujarat State (2.3 million meters)

Southeast Asia & Taiwan

- Operating earnings down 94% to HK$11 million: Significantly reduced contributions from Ho-Ping & Lopburi

- Renewables: Tariff reduction under Lopburi PPA

- Thermal: Solid operational performance from Ho-Ping. Impact of high coal prices was mitigated by a new agreement to adjust the energy tariff reimbursement mechanism from 1 July 2022 which accelerates the indexation to coal market price evolution

Outlook

- Thermal: Focus on managing fuel costs and supply as coal prices are expected to stay high. Continue to manage operations to deliver reliable return