Financial Performance

Strong performance in Hong Kong and Mainland China, more than offset by operational challenges from our generation portfolio in Australia, resulting in Group operating earnings (before fair value loss of HK$2,937 million on energy forward contracts in Australia) reduced by HK$2,291 million to HK$7,560 million. Total earnings decreased to HK$924 million after considering this unrealised fair value loss and items affecting comparability. Dividend is maintained at the same level as in 2021.

Revenue

Total Earnings

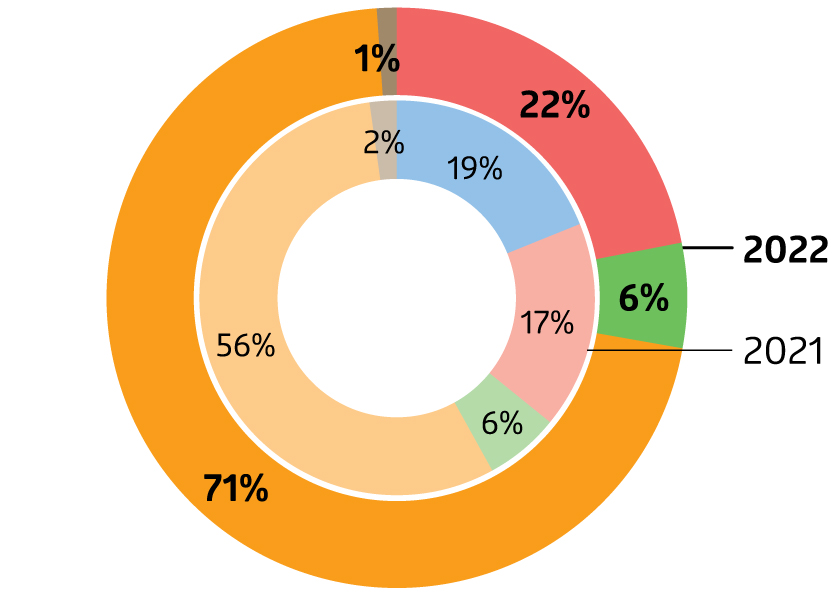

Operating Earnings* (Before Unallocated Expenses)

by Asset Type

Coal and gas

Nuclear

Renewables

Transmission, distribution and retail

Others

*Excluding fair value movements of energy forward contracts from EnergyAustralia

Capital Investments

Dividend per Share & Dividend Paid

Net Debt & Net Debt / Total Capital (%)

Two-year Summary

For the year (in HK$ million)

Revenue

Hong Kong electricity business

50,600

44,311

14.2

Energy businesses outside Hong Kong

48,873

38,941

25.5

Others

1,189

707

Total

100,662

83,959

19.9

Earnings

Hong Kong energy business 1

8,403

8,141

3.2

Hong Kong energy business related 2

263

301

Mainland China

2,229

1,660

34.3

Australia

(5,267)

(83)

India

193

221

(12.7)

Southeast Asia and Taiwan

11

173

(93.6)

Other earnings in Hong Kong 1

(65)

(18)

Unallocated net finance costs

(6)

(9)

Unallocated Group expenses

(1,138)

(869)

Operating earnings

4,623

9,517

(51.4)

Items affecting comparability

(3,699)

(1,026)

Total earnings

924

8,491

(89.1)

Net cash inflow from operating activities

12,734

17,806

(28.5)

At 31 December (in HK$ million)

Total assets

236,026

239,809

(1.6)

Total borrowings

59,217

58,215

1.7

Shareholders’ funds

105,498

113,034

(6.7)

Per share (in HK$)

Earnings per share

0.37

3.36

(89.1)

Dividend per share

3.10

3.10

-

Shareholders’ funds per share

41.76

44.74

(6.7)

Ratios

Return on equity 3 (%)

0.8

7.5

Net debt to total capital 4 (%)

32.0

28.1

FFO interest cover 5 (times)

7

12

Price / Earnings 6 (times)

154

23

Dividend yield 7 (%)

5.4

3.9

Notes:

- Reflecting our business initiatives in energy and infrastructure solutions in Hong Kong, the 2021 earnings of CLPe have been reclassified from other earnings in Hong Kong to Hong Kong energy business to align with current year presentation

- Hong Kong energy business related includes PSDC and Hong Kong Branch Line supporting SoC business

- Return on equity = Total earnings / Average shareholders’ funds

- Net debt to total capital = Net debt / (Equity + advances from non-controlling interests + net debt); debt = bank loans and other borrowings; net debt = debt – bank balances, cash and other liquid funds

- FFO (Funds from operations) interest cover = Cash inflow from operations / (Interest charges + capitalised interest)

- Price / Earnings = Closing share price on the last trading day of the year / Earnings per share

- Dividend yield = Dividend per share / Closing share price on the last trading day of the year