FinancialPerformance

Group’s operating earnings before fair value movements increased 8.1% to HK$10,949 million thanks to an overall solid performance from the portfolio with notable improvements from EnergyAustralia. Total earnings increased significantly to HK$11,742 million, after taking into account one-off items affecting comparability. Total dividends for 2024 increased to HK$3.15 per share.

Revenue

Total Earnings

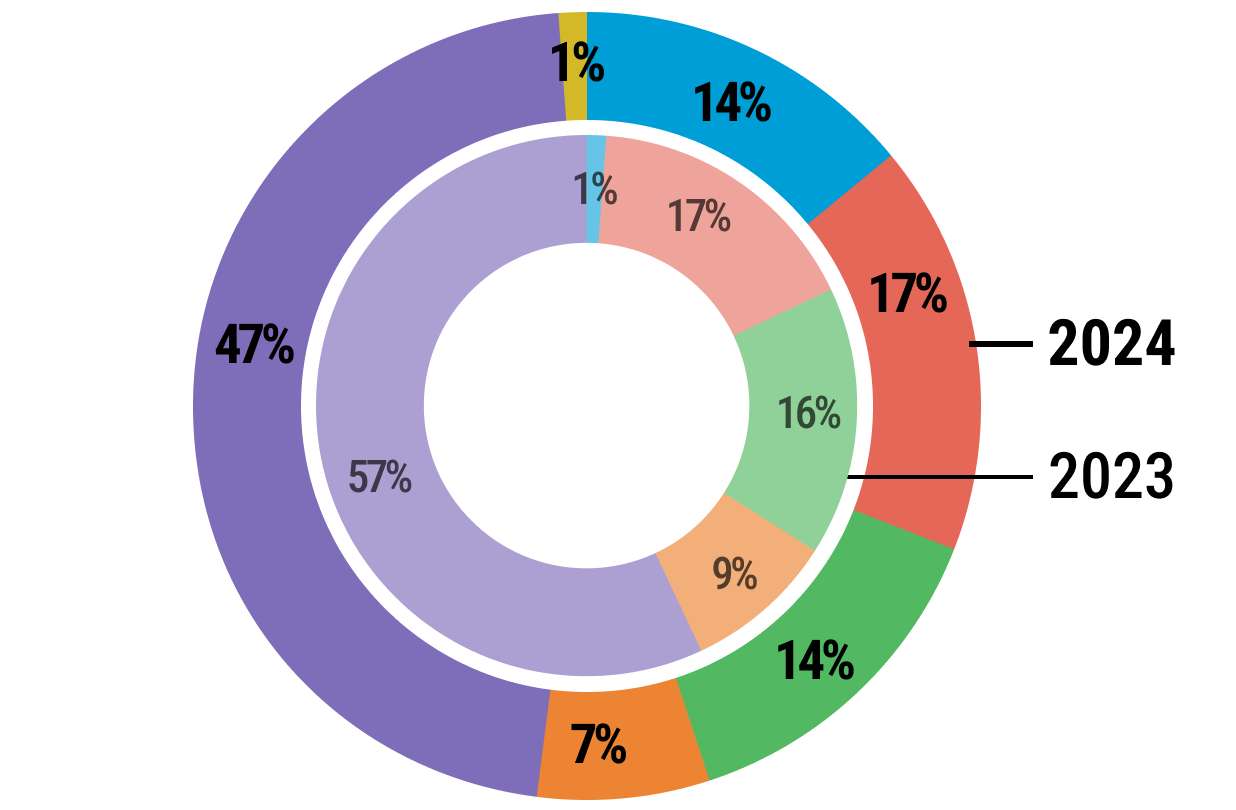

OPERATING EARNINGS BEFORE FAIR VALUE MOVEMENTS BY ASSET TYPE*

Coal

Gas

Nuclear

Renewables

Transmission, distribution and retail

Others

* Before unallocated expenses

Capital Investments

Dividend per Share & Dividend Paid

Net Debt & Net Debt / Total Capital (%)

Two-year Summary

For the year (in HK$ million)

Revenue

Hong Kong electricity business

50,657

50,630

0.1

Energy businesses outside Hong Kong

38,901

35,039

11.0

Others

1,406

1,500

Total

90,964

87,169

4.4

Earnings

Hong Kong energy business1

8,694

8,536

1.9

Hong Kong energy business related2

201

287

Mainland China1

1,851

2,073

(10.7)

Australia

591

(182)

India

329

301

9.3

Taiwan Region and Thailand

260

307

(15.3)

Other earnings in Hong Kong

(58)

(112)

Unallocated net finance income

45

43

Unallocated Group expenses

(964)

(1,126)

Operating earnings before fair value movements

10,949

10,127

8.1

Fair value movements

699

2,125

Operating earnings

11,648

12,252

(4.9)

Items affecting comparability

94

(5,597)

Total earnings

11,742

6,655

76.4

Net cash inflow from operating activities

23,140

23,567

(1.8)

At 31 December (in HK$ million)

Total assets

233,713

229,051

2.0

Total borrowings3

61,271

57,515

6.5

Shareholders’ funds

104,055

102,331

1.7

Per share (in HK$)

Earnings per share

4.65

2.63

76.4

Dividend per share

3.15

3.10

1.6

Shareholders’ funds per share

41.19

40.50

1.7

Ratios

Return on equity4 (%)

11.4

6.4

Net debt to total capital3, 5 (%)

33.0

31.6

FFO interest cover6 (times)

11

11

Price/Earnings7 (times)

14

25

Dividend yield8 (%)

4.8

4.8

Notes:

- Including CLPe business in Hong Kong and Mainland China respectively

- Hong Kong energy business related includes PSDC and Hong Kong Branch Line supporting SoC business

- Perpetual capital securities of HK$3,883 million at 31 December 2024 were reclassified from equity to other borrowings upon the issuance of redemption notice to the holders in December 2024, with the subsequent refinancing by the new perpetual capital securities in January 2025. As such, the amount remained as equity on a consistent basis with 2023

- Return on equity = Total earnings/Average shareholders’ funds

- Net debt to total capital = Net debt/(Equity + advances from non-controlling interests + net debt); debt = bank loans and other borrowings; net debt = debt – bank balances, cash and other liquid funds

- FFO (Funds from operations) interest cover = Cash inflow from operations/(Interest charges + capitalised interest)

- Price/Earnings = Closing share price on the last trading day of the year/Earnings per share

- Dividend yield = Dividend per share/Closing share price on the last trading day of the year