Strategic Framework

The CLP Group is one of the largest investor-owned power businesses in Asia Pacific. Our strategic priorities are to create a sustainable business portfolio, accelerate our response to climate change for our business and the communities we operate in, serve growing demand for energy solutions, leverage technology to deliver leading customer experiences and enhance operating performance, and invest to build an agile and innovative workforce.

Value Creation

INPUTS USED

WHAT WE DO

OUTPUTS

At CLP, we utilise various inputs to create value for shareholders, customers, employees and the wider community.

CEO Message

T.K. Chiang

Chief Executive Officer

Business Performance

Operating Earnings before Fair Value Movements by Region1

Hong Kong

Mainland China

India

Taiwan Region and Thailand

- Note: 1 Before Group expenses and excluding the operating loss of HK$182 million (2022: HK$2,330 million) from Australia

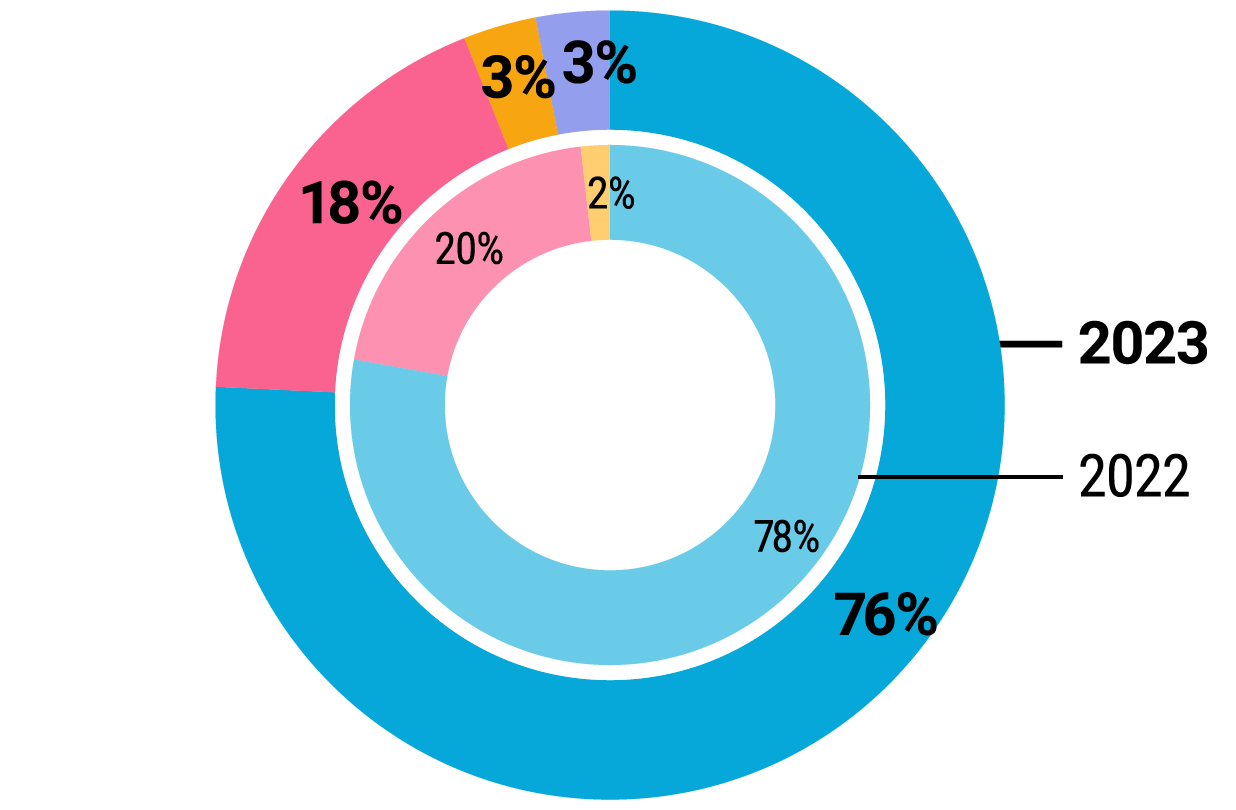

Group operating earnings before fair value movements increased 33.2% to HK$10,127 million. The diagram above shows the operating earnings before fair value movements by region where we operate.

Financial Performance

Group operating earnings before fair value movements increased 33.2% to HK$10,127 million attributable to dependable contributions from our core business in Hong Kong and Mainland China and significant improvement in overseas business. With the turnaround of fair value movements, from a loss of HK$2,979 million to a gain of HK$2,125 million, and after taking into account the items affecting comparability, mainly impairment of goodwill of the Customer business in Australia of HK$5,868 million, total earnings came at HK$6,655 million, a strong rebound from HK$924 million for 2022.

REVENUE

FIND OUT MORE

Get the full 2023 Annual Report, and read more about our sustainability performance and the Climate Vision 2050 Report.