Financial Performance

Group operating earnings before fair value movements increased 33.2% to HK$10,127 million attributable to dependable contributions from our core business in Hong Kong and Mainland China and significant improvement in overseas business. With the turnaround of fair value movements, from a loss of HK$2,979 million to a gain of HK$2,125 million, and after taking into account the items affecting comparability, mainly impairment of goodwill of the Customer business in Australia of HK$5,868 million, total earnings came at HK$6,655 million, a strong rebound from HK$924 million for 2022.

Revenue

Total Earnings

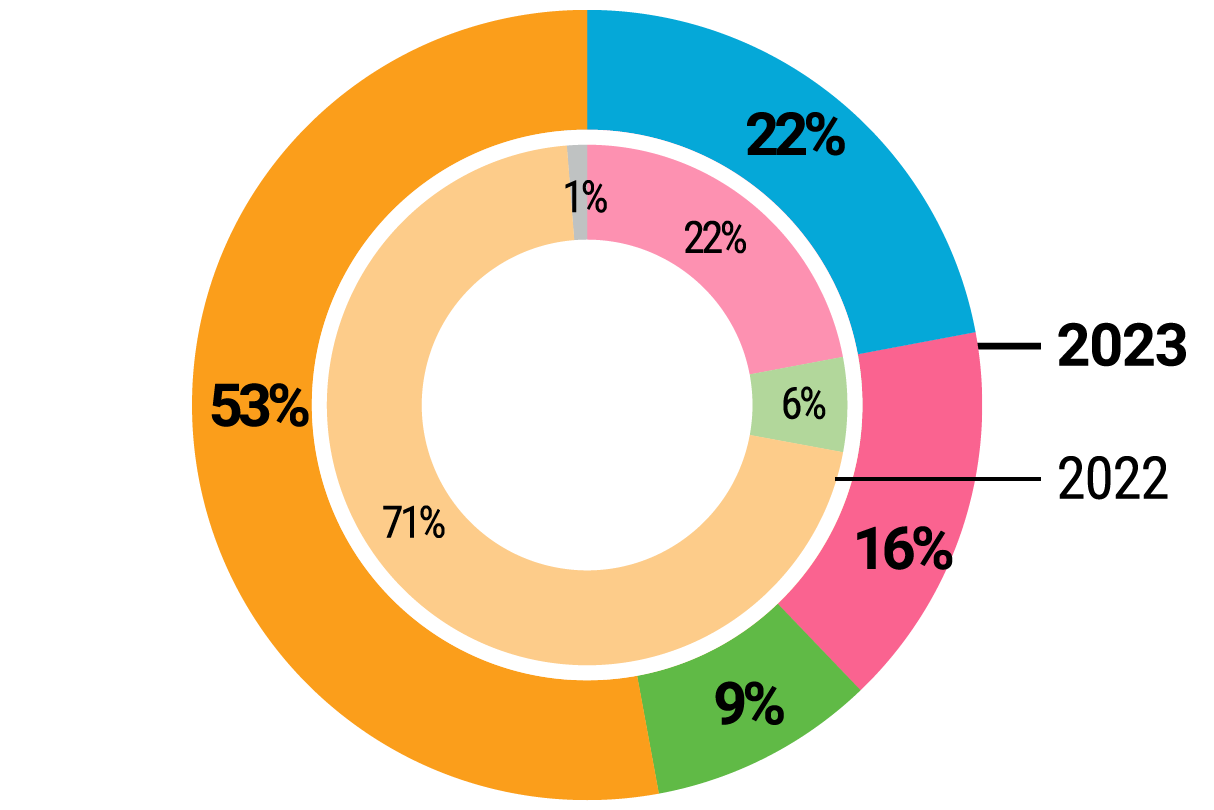

OPERATING EARNINGS BEFORE FAIR VALUE MOVEMENTS BY ASSET TYPE*

Capital Investments

Dividend per Share & Dividend Paid

Net Debt & Net Debt / Total Capital (%)

Two-year Summary

- Hong Kong energy business related includes PSDC and Hong Kong Branch Line supporting SoC business

- Return on equity = Total earnings / Average shareholders’ funds

- Net debt to total capital = Net debt / (Equity + advances from non-controlling interests + net debt); debt = bank loans and other borrowings; net debt = debt – bank balances, cash and other liquid funds

- FFO (Funds from operations) interest cover = Cash inflow from operations / (Interest charges + capitalised interest)

- Price / Earnings = Closing share price on the last trading day of the year / Earnings per share

- Dividend yield = Dividend per share / Closing share price on the last trading day of the year