Business Performance

- Robust operations and strong Hong Kong performance in 2021; continued to provide a steady electricity supply with a 99.999% reliability

- Notwithstanding that, Group operating earnings decreased 17.8% to HK$9,517 million mostly due to challenging energy market conditions in Australia and Mainland China

- Fourth interim dividend of HK$1.21 per share; total dividends for 2021 maintained at HK$3.10 per share

- Strengthened Climate Vision 2050; progressively decarbonising the business operations, provide sustainable and commercially viable energy solutions that will deliver net-zero for this generation and the next

- Remain cautiously optimistic on the region’s economic outlook, especially given the strengths in Hong Kong alongside long-term commitment in Mainland China

Performance by Region

Hong Kong

- Operating earnings increased 4.7% to HK$8,189 million, reflecting progress in major capital projects despite COVID-19 pandemic

- Electricity sales up 4.1% from 2020 with higher sales across all customer sectors

- Customer accounts increased from 2.67 million to 2.71 million

- Construction of advanced gas-fired generation unit at Black Point continued; offshore LNG terminal progressed

- Over 1.2 million smart meters installed and more than 260MW of Feed-in Tariff projects connected or approved

Outlook

- Current Development Plan capex increased by HK$3.2 billion to HK$56.1 billion; HK$24.3 billion remaining investment to end-2023

- Robust outlook with higher infrastructure spend and visibility on continuing decarbonisation pathway

- Tariff increase in place for 2022 reflecting higher fuel costs

- Pressure from international fuel prices and supply chain disruptions expected to continue

Mainland China

- Operating earnings decreased 25.7% to HK$1,660 million

- Strong nuclear results partially offset impact of higher coal prices; strong generation from Yangjiang, output from Daya Bay remained steady

- Renewables remained stable with lower hydro and wind partially offset by higher solar and full-year contribution from Laiwu III Wind Farm

- First grid-parity renewable energy project – Qian’an III Wind Farm – connected to the grid

- Delays in national subsidy payments for renewables continued to impact cash flow

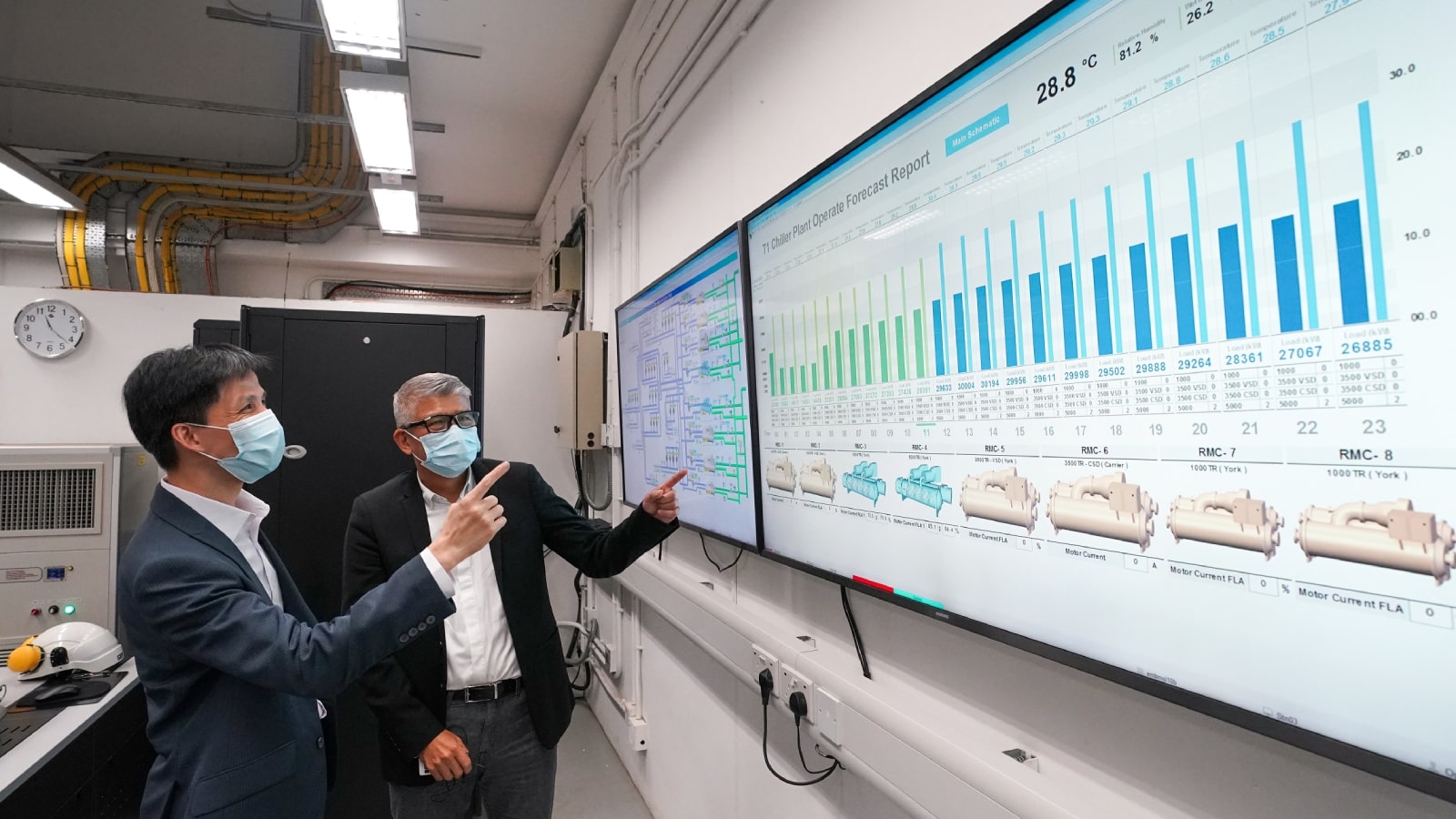

- Invested in the centralised cooling system at Po Park Shopping Plaza in Guangzhou

Outlook

- Coal pricing mechanism and tariff reform may help relieve pressure on margins in thermal portfolio

- Continuation of strong nuclear operations. Increased market sales risk exposure for Yangjiang

- Actively discuss the evolution of regulation and participate in carbon trading market

- Accelerate decarbonisation and continue investment in renewables

- Continue to explore opportunities in the Greater Bay Area including charging facilities for electric vehicles, energy management systems and energy infrastructure projects for industrial parks and commercial sites

Australia

- EnergyAustralia reported an operating loss of HK$83 million, compared with operating earnings of HK$1,690 million in 2020

- Severe impact from higher gas supply costs and lower electricity prices as energy transition accelerates; unfavourable fair value adjustments due to higher forward prices in 2021

- Sound operational performance in Energy business and improved availability

- Stabilisation of gross margin in Customer business, with focus on value per account. Lower bad debt, cost efficiency improvements and lower depreciation

- Generation margin declined on lower realised contract prices at Yallourn and Mount Piper power stations, higher gas supply costs, Yallourn mine suspension, accelerated depreciation from planned earlier closure of Yallourn

Outlook

- Competition and pressure on margins to remain intense. Focus on building a faster, more competitive Customer business, improving customer experience and the expansion of new products and services

- Continued pressure on wholesale margins from low electricity prices and high gas supply costs

- More investment in energy transition projects and optimise capital structure

India

- Rebranded as Apraava Energy to accelerate growth under a new corporate identity

- Operating earnings increased 26.3% to HK$221 million due to dependable renewables and transmission partially offset by major planned maintenance and lower capacity tariff at Jhajjar

- Higher wind generation and a full 12-month contribution from two new solar projects

- Higher operation and maintenance costs at Jhajjar due to major planned maintenance; lower capacity tariff

- Reliable operation in transmission with stable earnings. Completed acquisition of KMTL project in December 2021

- Received registration to participate in new greenfield bidding opportunities

Outlook

- Continue investments in non-carbon assets under the partnership with CDPQ

- Progress Sidhpur wind farm construction and continue to pursue renewable receivables

- Aim to double size of portfolio in next two to three years

Southeast Asia & Taiwan

- Operating earnings decreased 55.2% to HK$173 million

- Earnings from Ho-Ping Power Station in Taiwan reduced on higher coal costs and lower energy tariff with usual one-year time lag

- Stable earnings from Lopburi Solar Farm in Thailand with steady solar resource

Outlook

- High coal prices likely to continue to put pressure on margin

- Continue to manage investment to deliver reliable return

- Reduction in contribution from Lopburi following tariff reduction under PPA