- Shareholders’ funds of HK$113,034 million

- Total borrowings of HK$58,215 million

Value Creation

HOW WE CREATE VALUE

At CLP, we utilise various capitals to create value for shareholders, customers, employees and the wider community. The following diagram shows the key capitals we used and the value we created for different stakeholders.

INPUTS / CAPITALS

Financial Capital

Risks

- Financial risk

- Commercial risk

Manufactured Capital

- Generation capacity of 20,018 equity MW

- Long-term capacity and energy purchase agreements of 5,090MW

- Transmission and high voltage distribution lines of 16,834km

- 15,441 primary and secondary substations in Hong Kong

Risks

- Operational risk

- Extreme weather as a result of climate change

Human Capital

- 8,116 employees

Risks

- Human resources risk

- Health and safety

Intellectual Capital

- Strengthened technological capabilities to develop Energy-as-a-Service business model

- Digitalisation of operations

- Investments in technology companies and funds

- Partnerships with innovation accelerators

Risks

- Commercial risk

Natural Capital

- 426,190TJ of coal consumed

- 142,304TJ of gas consumed

Risks

- Climate change

Social and Relationship Capital

- Engagement with policymakers and stakeholders toward net zero

- Public education towards greater energy efficiency and decarbonisation

- Community support to mitigate the impact of COVID-19

Risks

- Regulatory risk

- Market risk

WHAT WE DO

We operate in different parts of the energy value chain in each of the markets we are in, tailoring our solutions based on the local context.

Generation

Transmission

Distribution

- Procure adequate and appropriate fuels and energy resources from diversified sources

- Design, build, operate and invest in centralised and decentralised generation facilities with increasing deployment of low-carbon energy sources

- Design, build, operate and enhance transmission networks to facilitate integration of more clean energy into the grid

- Design, build and operate distribution networks

- Integrate distributed energy resources into the grid

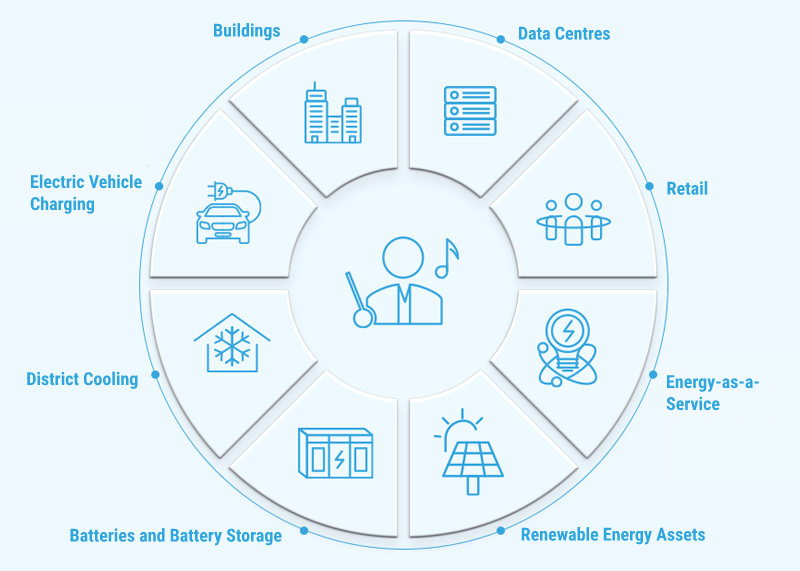

Energy Orchestration

- Develop and deploy customer-oriented, technology-enabled energy services that help customers become active participants of a power system

- Widen and deepen customer relationships as an energy orchestrator to enable decarbonisation, electrification, energy efficiency and management, decentralised generation and storage

NEW TECHNOLOGIES AND DIGITAL APPLICATIONS

- Data analytics, artificial intelligence and Internet of Things (IoT) facilitate flexibility of entire energy system

- Enable dynamic system balancing that integrates centralised and decentralised generation, and balances demand against different generation profiles to optimise cost efficiency, reliability and environmental performance

- Enable delivery of smarter and greener energy products and services

OUTCOMES

FINANCIAL CAPITAL

- Reliable and consistent ordinary dividends with steady growth supported by earnings

- Timely repayment to lenders

- Sustainable financing

MANUFACTURED CAPITAL

- Maintaining operational excellence despite challenges in weather conditions, fuel prices and COVID-19 to provide reliable, cleaner and affordable electricity supply

HUMAN CAPITAL

- Initiatives to promote staff wellbeing amid COVID-19

- Improvement on safety performance

INTELLECTUAL CAPITAL

- Flexible, environmentally-sustainable energy solutions for customers with increase in sales from Smart Energy Connect

NATURAL CAPITAL

- Updated Climate Vision 2050 to achieve net zero by 2050 and phase out coal by 2040

- Expansion of renewable energy portfolio

SOCIAL AND RELATIONSHIP CAPITAL

- Strong focus on engagement with our key stakeholders to plan for and execute a just energy transition

- Provided support to the communities to mitigate pandemic-related impacts

OUTPUTS

Economic value generated of

HK$85,088 million

FINANCIAL CAPITAL

- Shareholders: total dividends of HK$7,832 million, HK$3.10 per share

- Lenders: net finance costs of HK$1,774 million

MANUFACTURED CAPITAL

- Suppliers and Contractors: fuel and other operating costs of HK$58,428 million

HUMAN CAPITAL

- Employees: staff expenses of HK$5,107 million

SOCIAL AND RELATIONSHIP CAPITAL

- Government and Regulators: current income tax of HK$1,720 million

- Community: donations of HK$15 million